Tesla’s stock experienced a drop following its announcement of a decline in annual deliveries for the first time. The company’s fourth-quarter and year-end vehicle production and delivery report came after a significant surge in its stock price at the end of the year.

In 2024, Tesla reported deliveries of 1.789 million vehicles, a 1% decrease from the 1.809 million delivered in 2023.

The first quarter of the year proved challenging for Tesla, with CEO Elon Musk cautioning investors about slower growth prospects. However, the company managed to deliver better results by the year’s end, alleviating some concerns.

Once a dominant player in the electric vehicle market, Tesla now faces stiff competition, particularly from Hyundai and China-based BYD, which are rapidly gaining ground in the EV sector.

Historical Stock Performance

Tesla’s stock has shown significant growth over the years. In 2024, the stock reached an all-time high closing price of $479.86 on December 17. Over the past 52 weeks, the stock price has ranged from a low of $138.80 to a high of $488.54, with an average price of $230.51.

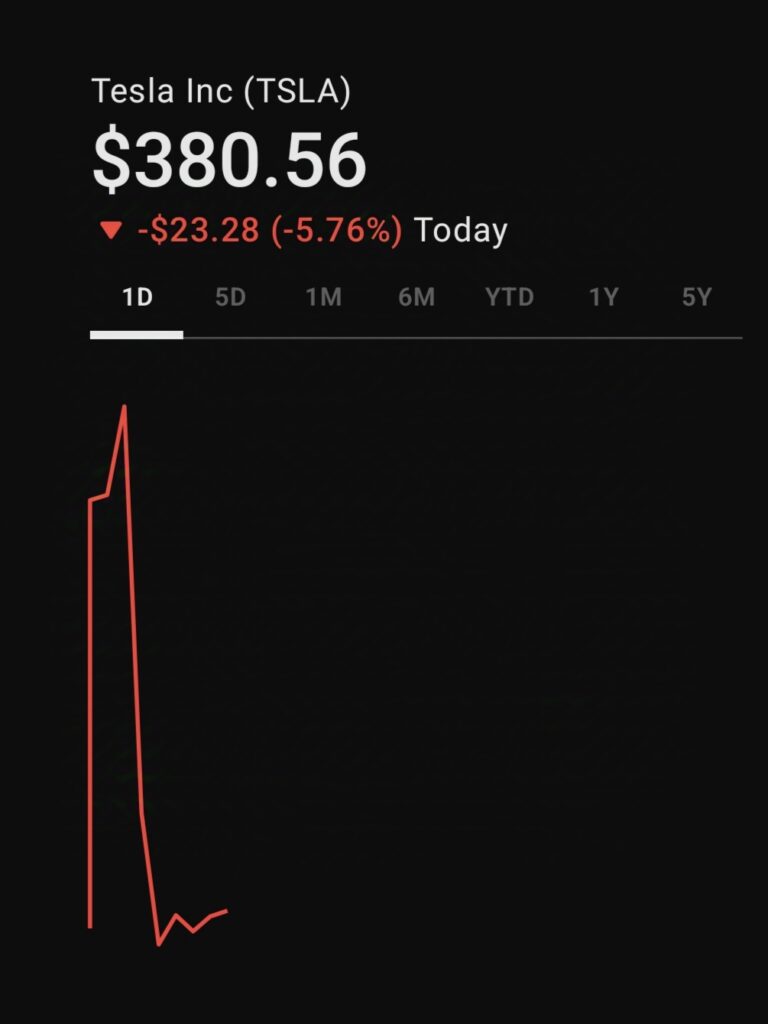

Current Stock Price

As of January 2, 2025, Tesla’s stock performance is as follows:

Investors are closely monitoring Tesla’s strategies to address increasing competition and maintain its position in the evolving EV market.